Sapiens Decision Resources

For those of you who want a lot of information, dig right in.

Don’t worry, there won’t be a test later.

- Blogs

- Brochures

- Case Studies

- News/Events

- Infographics

- Press Releases

- Training

- Videos

- White Papers / Research

A BBC 2023 Travelogue

Introduction Who doesn’t enjoy a visit to Las Vegas? Even when on business, a trip to America’s Playground is always a welcome change of pace and a great backdrop in which to network, discover new opportunities, and strengthen partnerships. The Sapiens Decision team...

Breaking the Mold: How Decision Automation is Revolutionizing Banks’ Regulatory Reporting

Whenever I speak with banking executives about operational issues, I always pause after mentioning “regulatory reporting” or “compliance requirements” to allow for their predictable reaction of complaints. Their responses are mainly due to the burden of ensuring the...

Unleash the Logic! 10 Reasons Why I’m Wild Over Decision Automation – Part 2

See Part 1 here In my last blog, I let everyone know how exciting I thought business logic can be when it’s transformed by decision automation. Here is another batch of decision automation examples from Sapiens Decision’s client projects. As I described previously,...

Unleash the Logic! 10 Reasons Why I’m Wild Over Decision Automation – Part 1

It sounds like a contradiction in terms: “unleash the logic”. Business logic in insurance, like “if a safe driver renews her policy, then provide a discount”, is well, logical. Constrained. Unexciting. But amazing things can happen when logic is managed independently...

Create products, not spreadsheets

We ♥ spreadsheets I work with lots of different clients, usually business analysts, and all very smart. I’ve observed that a lot of them manage their work using one or more spreadsheets. They know that to make business decisions in their daily work, flexible tools are...

Forget Business as Usual for the Mortgage Industry

Save $1M on just 2,000 loans by adopting Decision Management We all saw it coming. Interest rates are rising and volumes of both refinances and purchases are declining. Anyone who’s been in the mortgage industry long enough has seen this movie before, right? Except…...

Almost Perfect Means Room for Improvement

Optimizing Treasury operations with decision automation Top performers in any field – athletes, entertainers, celebrity chefs and executives – all strive for perfection — that elusive quality that sets them apart. Perfection brings personal satisfaction, financial...

It’s Official: Business Rules Engines are Out, Decision Automation is In

Gartner recently posed the question, “Are business rule engines obsolete?” Their report goes on to say that current Business Rules Management Systems (BRMS) are losing ground to Decision Management Systems (DMS), which take a more holistic view of the decision...

Logic Unleashed with Decision Management

Mortgage providers experience pain points that impact profitability, like updating their LOS quickly, relying on vendors for system updates or maintaining checklist processes. A better way is adopting decision management to drive greater speed, control and growth....

Faster Time to Market Requires Faster Decisions

Decision logic reflects your business policies, regulations, and operating procedures. It’s this logic, integrated with AI models and enterprise systems, that needs to stay current… otherwise you’re stuck behind the competition. Sapiens Decision eliminates the backlog...

Decision Management Overview

Decision-Management-OverviewDownload

Sapiens Decision for Mortgage Originators

Decision-for-Mortgage-OriginatorsDownload

Sapiens Decision for Insurance

BR_Sapiens-Decision-Overview_NADownload

Optimizing the claims experience at Hiscox

Global Bank Optimizes Cash and Liquidity

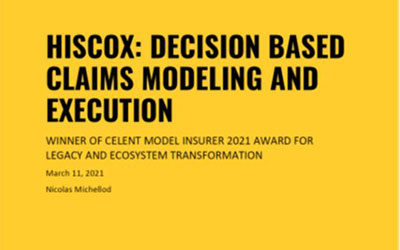

Celent: Decision Based Claims Modeling and Execution (Hiscox)

Hiscox Case StudyDownload

Creating a Digital Business with People and Technology

CS_Sapiens_Decision_Creating_a-_Digital_Business-with-People-and-Technology_NADownload

Customer Centricity to Strengthen Market Leadership (Hiscox)

CS_Sapiens_Decision_HiscoxDownload

Underwriting Modernization for Business Agility

CS_Sapiens_Decision_Underwriting-Modernization_NADownload

Sapiens Decision sponsoring and presenting at BBC 2024

Sapiens Decision is thrilled to announce our sponsorship and exhibition at the upcoming Building Business Capability 2024 conference in Orlando. As a leading provider of decision management solutions, we invite all participants to visit our booth and discover our...

Sapiens Decision’s new product strategy embraces AI

Announcing Parameter Management (PaM)

Fast Just Got Faster Sapiens Decision Parameter Management (PaM) module boosts flexibility and accelerates time-to-market. If you’re using Sapiens Decision, you know the speed, accuracy, and operational efficiency gains of separating your business rules from...

Webinar: Why your BA Toolkit should include Decision Modeling

Link to Webinar Replay

Sapiens Decision sponsoring and presenting at BBC 2023

Caesars Forum, Las Vegas, May 10-11 Sapiens Decision’s Practice Manager, Roland Philbin, will be leading an in-depth discussion, interactive training session, and demo to show how business logic solutions can make large-scale digital transformations happen. From...

Announcing Automated Logic Extraction (ALE)

Legacy code is everywhere. Conservative estimates put the current COBOL code base at 300 billion lines of code and Java is perhaps double that amount. Whatever programming language used today is the legacy code of the future. Thousands of businesses still run their...

Sapiens presenting at InsureTech Connect (ITC) 2022

Sapiens Decision is taking an active part in this year’s InsureTech Connect (ITC) 2022, September 20-23 in Las Vegas! ITC is the world’s largest insurtech event – offering unparalleled access to the most comprehensive and global gathering of tech entrepreneurs,...

Launch Insurance Innovation and Frontier Technologies (LIIFT)

LIIFT 2022 will bring together over 200 senior insurance leaders from the North American marketplace to discuss innovation and the future of the industry through a series of interactive focus groups and presentations. Innovation is the central theme of the event...

Decision at IIBA Building Business Capability Conference

Sapiens Decision will be exhibiting at the International Institute of Business Analysts (IIBA) Building Business Capability (BBC) conference at the Diplomat Resort in Hollywood, FL on June 28-29th. The BBC conference is the premier event for the IIBA and provides...

Decision at MBA Technology Solutions Conference

This year was never destined to be business as usual. The Great Resignation, work from home, a booming real estate market and new market volatility from recent events are signs that the industry needs to rethink some fundamental assumptions. We look at industry...

APR 18, 2024

New Sapiens Decision Automated Logic Extraction (ALE) Solution Reduces Legacy System Transformation Costs by 50%

SEP 19, 2022

Berkshire Hathaway Guard Insurance Companies Achieve Agility and Decision Automation with Sapiens Decision

OCT 25, 2021

Latest Release of Sapiens Decision Empowers Insurers to Manage Virtually Unlimited Decision Logic Changes in Minutes

JUL 14, 2021

Sapiens' Decision Management Platform Selected by Home Point Financial

JUL 13, 2020

Sapiens' Decision Management Platform Selected by American Family Insurance

MAY 26, 2020

Sapiens Decision Wins a 2020 HW TECH100 Mortgage Award

MAR 23, 2020

The Decision Model Certification Process

The Decision Model Certification ProcessDownload

A Primer on the Decision Model

A Primer on The Decision Model 2021-12-15Download

Video: Why Decision?

Sapiens Decision co-founder, Larry Goldberg, describes why Decision is needed https://youtu.be/C4hV2SgGVso

Video: Creating a Decision View

https://youtu.be/z8InO50r298

Video: Creating a Fact Type

https://youtu.be/1Et8ahOfW_4

Video: Creating a supporting Rule Family View

https://youtu.be/9-c0xVckE5A

Video: Editing a Rule Family View

https://youtu.be/tqprODMCFso

What CIOs Want from Decision Management

Why Sapiens Decision?

Download Whitepaper: Why Sapiens Decision?

We already have a Business Rules Management System. Why do we need a Business Decision Management System?

Whitepaper: We Already Have a BRMS Why Do We Need a DMSDownload